In today’s world, we depend on transportation companies for nearly everything we use, from food and clothing to electronics and medical supplies. Every year trucks, buses, and commercial vehicles travel billions of miles, delivering goods across the country. The Federal Motor Carrier Safety Administration (FMCSA) plays a crucial role in regulating this vital industry, helping to ensure both public safety and the financial security of transportation operations. This article will explore the FMCSA’s impact on public safety, outline insurance requirements based on vehicle weight, and examine recent industry changes and trends shaping the future.

Why the FMCSA Matters: Safety and Accountability

The FMCSA, part of the U.S. Department of Transportation, was established to reduce the number of crashes, injuries, and fatalities involving large trucks and buses. With commercial vehicles covering millions of miles each year, this agency enforces strict regulations to keep drivers and the public safe.

One of the primary ways the FMCSA protects the public is by ensuring that motor carriers—companies that operate trucks and buses—carry adequate liability insurance coverage. This requirement guarantees that if an accident occurs, there are financial resources available to cover damages, medical bills, and other costs.

Public Dependence on Motor Carriers

To understand the importance of the FMCSA's role, it helps to consider how much the public relies on motor carriers:

- Over 80% of goods in the U.S. are transported by truck, including essential items like food, medicine, and fuel.

- Trucking companies alone moved over 11.8 billion tons of freight in recent years, and that number is growing.

Without motor carriers, our supply chain would grind to a halt, impacting nearly every industry. Our dependence on trucking companies became even more evident during the COVID-19 pandemic. Just think of the steady flow of packages arriving at your doorstep each week. This widespread reliance makes safety and accountability in transportation more important than ever.

FMCSA Insurance Requirements Based on Vehicle Weight

Insurance requirements for motor carriers vary depending on the weight and use of the vehicle. The FMCSA sets specific minimums to cover potential damages, which vary by the type of cargo and the weight of the vehicle. Here’s a breakdown:

|

Vehicle Type

|

Minimum Insurance Requirement

|

|

For-Hire Vehicles Carrying Household Goods (10,001+ lbs)

|

$750,000

|

|

For-Hire Vehicles Carrying General Cargo (10,001+ lbs)

|

$750,000

|

|

Vehicles Transporting Hazardous Materials

|

$1,000,000 - $5,000,000 (depending on material type)

|

These minimums ensure that motor carriers have the financial means to cover damages in the event of an accident, protecting the public and businesses alike.

Insurance Filing Requirements for Motor Carriers

To legally operate as a motor carrier, transportation providers must secure the appropriate truck liability insurance based on the above requirements and request federal filings from the insurance carrier to be posted with the FMCSA. These filings include:

- Form MCS-90: This form guarantees that a motor carrier meets minimum liability coverage as required by the FMCSA.

- Form BMC-91 or BMC-91X: Used to certify insurance coverage for bodily injury and property damage.

Additionally, the FMCSA requires that all commercially owned and/or operated vehicles be listed on the policy with federal filings. This rule ensures comprehensive coverage and reinforces accountability for companies managing fleets of vehicles.

Recent Changes in the Transportation Industry

In recent years, several trends have reshaped the transportation industry, prompting updates and adjustments to FMCSA regulations and motor carrier requirements:

- Increased E-commerce Demand: With online shopping growing at record rates, the demand for trucking has surged, putting additional pressure on carriers to deliver goods quickly and safely. This trend has led to higher insurance costs due to increased mileage and higher accident risk.

- New Safety Technologies: Advances in technology, such as electronic logging devices (ELDs), GPS tracking, and collision avoidance systems, have helped improve safety on the roads. The FMCSA now mandates ELDs in most commercial vehicles, which helps enforce hours-of-service (HOS) regulations and reduces driver fatigue.

- Insurance Premium Increases: The rising frequency and severity of accidents have led to increased insurance premiums for motor carriers. This trend has made it more challenging for smaller companies to maintain compliance while balancing costs.

Chart: Industry Changes in the Last 5 Years

|

Change

|

Description

|

Impact

|

|

E-commerce Growth

|

Increased demand for transport

|

Higher insurance premiums

|

|

Safety Technology

|

Widespread adoption of ELDs, GPS, and more

|

Improved driver safety

|

|

Insurance Costs

|

Rising premiums due to more frequent and costly accidents

|

Financial strain on small carriers

|

Future Projections for the Transportation Industry

Looking forward, the FMCSA and the motor carrier industry face several challenges and opportunities:

- Growing Adoption of Electric Vehicles (EVs): With sustainability becoming a priority, the industry is expected to see a shift toward electric trucks, which could reduce emissions and improve cost efficiency over time.

- Further Insurance Adjustments: As technology advances, insurance companies may use data from ELDs and GPS tracking to customize policies based on driving patterns, potentially leading to more personalized premiums. Some of those changes have already been adopted by many insurance companies.

- Increased Focus on Safety Compliance: Safety will continue to be a major focus, with stricter requirements likely for hazardous materials transport and possibly higher minimum insurance limits.

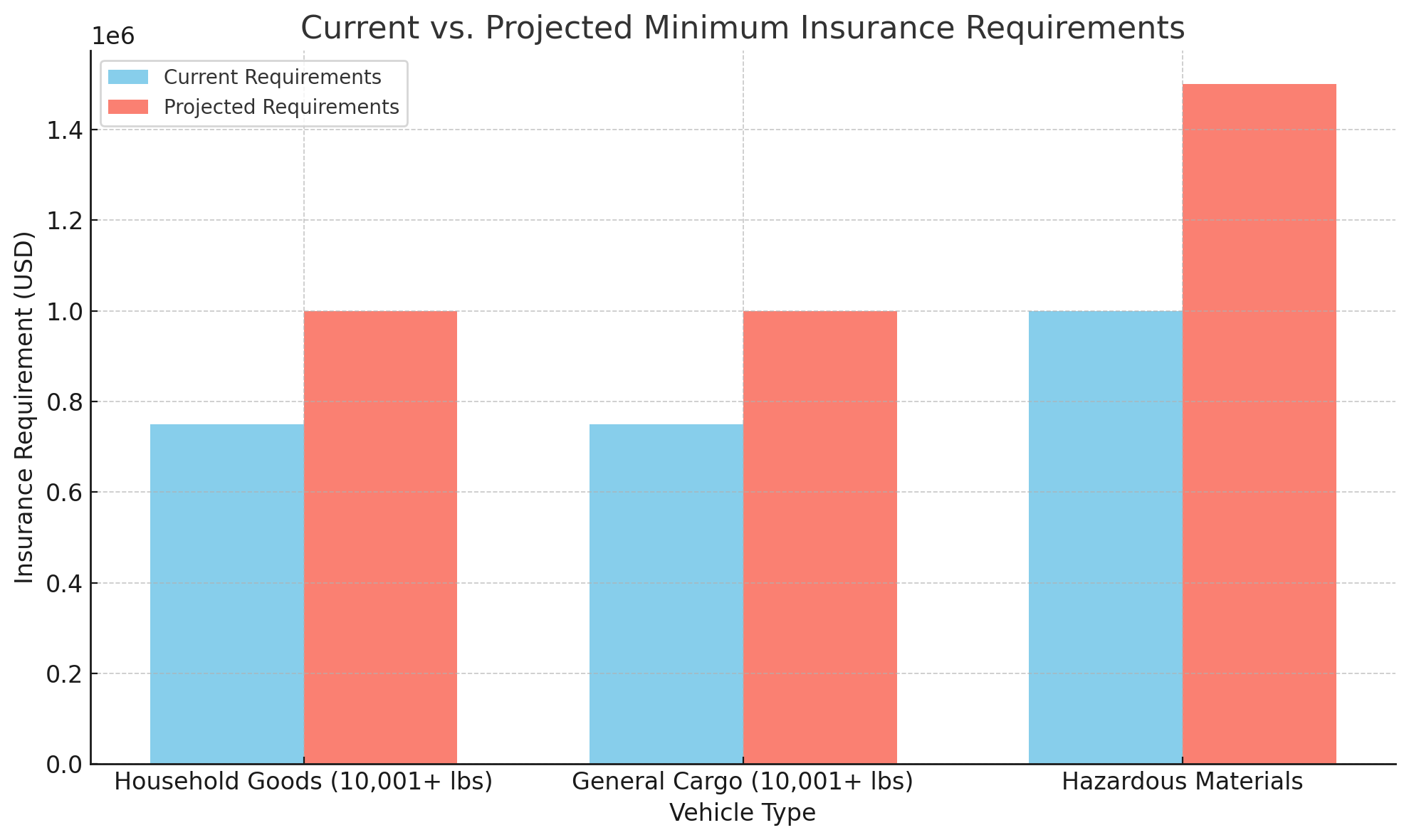

The bar chart below illustrates some of the projected increases in truck insurance requirements anticipated to be enacted by the FMCSA in the near term:

Future Trends in Transportation Industry Insurance Requirements

Staying Ahead in a Changing Landscape

The FMCSA’s commitment to safety and insurance requirements for motor carriers helps keep roads safe for everyone while ensuring companies can operate responsibly. With new trends reshaping the industry, carriers will need to stay informed and adaptable to meet evolving regulations and standards.

Are you prepared for these changes? Visit www.TCIIns.net to learn more about securing the right insurance coverage for your business.